Brand Experiences

Passion for Pets: The Future Growth of Pet Care

By Andreas Schambeck

People love their pets. This is neither a surprising nor profound observation, but consumers’ love of their pets is responsible for the largest growth in the pet care market ever seen.

The pet care industry has been on an upward trajectory for several years, growing in line with other CPG categories. But as Mintel notes, when the pandemic began, changes in routines impacted consumers’ relationships with their pets. For many pet owners, lockdown meant spending significantly more time with their pets, who became the main source of companionship and comfort. The strengthened bond between pet and owner has led owners will look for ways to further pamper their pet as a token of appreciation.

Global spending has increased in the pet care category from €123 billion in 2020 to more than €133 billion in 2021. In the United States, spending has doubled in the last 10 years. The United Kingdom is the top spender in Europe with €5.5 billion, closely followed by Germany.

Last year, there were no signs of a slowdown in the momentum of this category either. More than one in four pet owners have acquired a new pet in the past twelve to 18 months (Forsa survey, 11/2021). As the number of pet owners continues to grow, we can assume that the industry will grow with it.

Given the strengthening bonds between pets and their owners and their owners’ willingness to express their love with their wallets, there are several long-term trends that will continue impacting the pet care industry. Let’s look at a few.

Pets Are People Too

In the past, pets often played a functional role within a family, such as guard dogs or barn cats. But in recent years, pets have started playing a much more important role: fur babies.

Millennials, who are forgoing or delaying traditional milestones such as marriage and child-rearing, are turning to their pets to play a familial role. For example, more than three-quarters of female Millennials (76%) refer to their pet as their “fur baby”, according to Statista.

As pet ownership has grown worldwide to nearly 57% of consumers (GfK), fur babies have become as highly regarded as their two-legged counterparts. According to a survey conducted by Fortune as far back in 2016, 76% of pet owners consider their pets to be family members.

And as the importance of pets as family has grown so too has their humanisation. Pet owners not only want to meet the basic needs of their animals, but they also want the best for them: To give them a happy, healthy, fulfilled life.

In fact, the humanisation of our pets is an overarching trend that is spurring a host of other trends across the category, from the premiumization of pet foods & treats to sustainable packaging to the proliferation of wellness-oriented products and services.

From PetBnBs to intelligent cat litter, petcare has new product categories.

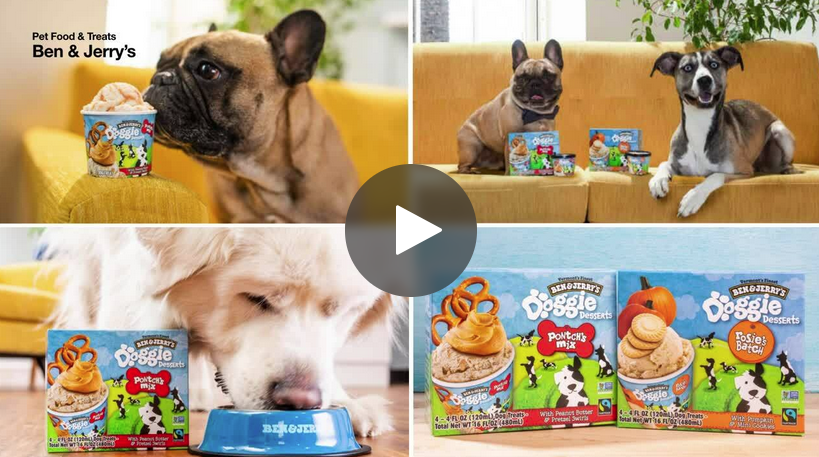

The humanisation of pets is leading to an explosion of products and services that offer their fur babies experiences previously reserved for their owners. In some cases, new product categories have emerged: wet wipes, toothpaste, innovative calming products, PetBnB, smart cat litter or special mattresses for the animals.

Over the past two years in particular, the focus has been on pet-related activities, healthy nutrition, and new acquisitions for the homes of humans and animals. Healthy treats and the “supplies and accessories” segments are driving the market.

Pet owners look for sustainability and transparency, which influences the purchase of food and care products for their animals. They spend more on organic, natural foods, want to offer their pets a higher quality of life and more personalised care, and choose brands and retailers that contribute to animal welfare.

For example, 71% of Gen-X are pet owners, and they tend to spend most on their pet’s diet and welfare now that they have significant disposable income.

In addition, increasing pet ownership is supported by a growing body of scientific evidence on the physiological and psychological benefits of pet ownership. For pet product manufacturers and retailers—from food to grooming to accessories and services—this changing market presents numerous opportunities: coordinated meals for humans and dogs, partnerships between delivery services and “poop-up” shops, or subscription models for boxes with age-appropriate training.

A high affinity for technology can be observed among pet owners. This is shown by the interest in telemedicine, smart collars, or the app for the aquarium. Here, a disproportionate amount of research is done on the internet before the purchase. And some of the animal pets have their own Twitter/Instagram accounts.

Young companies in particular often focus on technical, digital products and services, such as DNA tests, GPS tracking, 24/7 vet support or insurance. However, in addition to many start-ups, increasingly established players are also directing consumers towards their new services and products in pet medicine, customised pet food, pet insurance, and related areas. If the forecasts for the growth of the pet market remain stable, significant growth can be seen here in the coming years.

eCommerce vs. In-Store: It’s About the Experience

Online and mobile shopping in the pet industry is booming. Pet supplies are already among the top 10 product categories for smartphone shopping in Germany with 12.3% (source: Wirtschaftswoche). Especially pet food, with fixed regular shopping rhythms, is perfectly suited for convenient (re)ordering with the mobile phone.

The increasing importance of the internet for the purchase of pet products has once again become noticeable, especially in 2020, the first year of the pandemic. In Germany, for example, sales volume was approximately 822 million euros, 117 million euros more than in 2019, an increase of over 16 percent.

eCommerce is expected to drive future growth in this category, although the annual growth rate will slow as the pandemic subsides. According to Statista, global ecommerce will account for nearly one-third of total sales in this category by 2025.

The stationary offer will nevertheless remain important. In many countries, food retail is still the strongest sales channel for pet food. Specialist retailers, on the other hand, often continue to be the leaders for supplies and accessories. Basically, the retail trade will profit wherever it can create individual experiences and convince with an expert staff and good advice.

Hybrid sales models, specialized marketplaces, and direct-to-consumer (D2C) sales will continue to play an increasing role in the pet industry. In Germany, for example, own online brand shops and parallel distribution via the retail trade work well together, with both sides seeing benefits.

Competition in this category is getting tougher and tougher. On the one hand, small, new, national brands benefit and prevail over bigger brands; on the other hand, discounting can gain strength compared to other retail channels.

According to data from IRI, mass and specialty shops perform better with younger customers, which could give these retailers an advantage in the future. And online, challenger brands continue to steal market share from established market leaders, as the top 10 brands account for only 40% of ecommerce sales (US), according to 1010data.

Think & Link Marketing Channels

Omnichannel brand experience and customer journeys—creating seamless experiences for consumers across all channels and touchpoints—will remain a high priority in 2022 for the pet category.

Inevitably, the pressure has increased for all market participants to become more active across channels. Young companies with hybrid business models, for example, usually find it easier than established pure players regardless of whether they operate online or in brick-and-mortar shops.

In any case, there is a lot of movement in the German pet market. While top dog Fressnapf is still comparatively small online, the Krefeld-based company has been thinking and acting in its own ecosystem for its customers and partners instead of in channels for some time.

Futterhaus, on the other hand, is only now deciding whether to enter the online business, and the Rewe Group is now venturing into the stationary specialist store sector with the ZooRoyal brand. But everyone is moving. Companies like AlphaPet Ventures show that a technology-driven brand platform approach and multi-channel sales with B2B and stationary retail partners go very well together.

Omnichannel, with its higher level of interconnectedness, is more advantageous for both customers and companies, but at the same time, it is also much more complex to implement. Processes must be consistent across all channels and networked to such an extent that all actions can be tracked in real-time.

Pure players should therefore try their hand at multi- or omnichannel and gain initial experience, for example, through first cross-channel activities (click & collect or similar). It is important to remember that the more seamlessly the channels, touchpoints, and points of sale are networked and interact with each other, the more complex the customer journey, its control, and the aspect of the “moment of truth”.

But regardless of whether multichannel or omnichannel: The customer must be at the centre of all efforts. He decides how he wants to shape the business relationship. And they must be given the best possible experience with the company.

While the pet care boom will likely continue for the foreseeable future, brands that can further strengthen the bond between owners and their fur babies will thrive. Given the industry’s ecommerce market has not yet reached full maturity, space still exists for the development of new products and new channels that cater to pets and humans alike